Your Future

At East Coast Credit Union, we offer access to a comprehensive range of investment products and services that suit your investment needs and the financial expertise to help achieve your goals.

Whether you’re just beginning to save and looking for a Tax-Free Savings Account or approaching retirement and looking for more information on opening a Registered Retirement Income Fund, we can help.

Investment Options

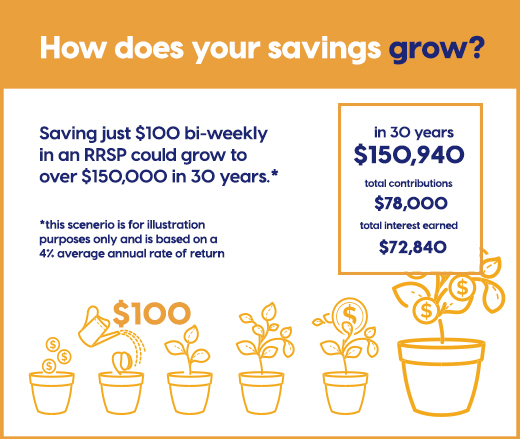

We know you have to plan for the future and you need your money to grow. That’s why we provide access to a full range of account, investment, insurance and lending products customized to get you to your goals.Our wide range of registered and non-registered investment options as well as insurance, trust and tax services give you the power to choose the products that best meet your needs. We can walk you through savings and borrowing strategies that make sense given your income and your retirement goals.

|

First Timer |

Getting your savings started. You’re hitting the ground running. You’ve landed your first “real” job, you’re getting married, or starting a new family—or maybe all three! It’s an exciting time in your life. And it can be difficult to think about saving for your retirement when everything is just beginning. But this is the perfect time, because time is on your side. |

|

Builder |

Growing your savings. Your life is at its busiest. Your kids are growing and always going, your career is in full swing, you’re there for your friends, parents, community, and even manage some time for yourself occasionally. Most likely you’ve been contributing to a savings plan for some time now. But when’s the last time you took a second look at your plan to make sure it’s working as hard as you are? |

|

Retiring Soon |

Managing your savings. You’re almost there! You’ve worked hard, saved smartly, and soon it’ll be time to enjoy a well-deserved retirement. But now that you’re in the homestretch of your retirement savings plan, there a few things well worth taking the time to consider. |

Expert Articles and Brochures

Whether you’re just getting started, or fully engaged in your quest for more information, our expert articles will help shed light on your RRSP questions.

Understanding RRSPs

Understanding TFSAs

Comparing RRSPs and TFSAs

First Timer's Guide to Saving & Investing

First Timer's Guide to Retirement

Real talk: What happens if your retirement savings runs out

Why saving for retirement is such a big deal

How, when and why to withdraw from your registered savings